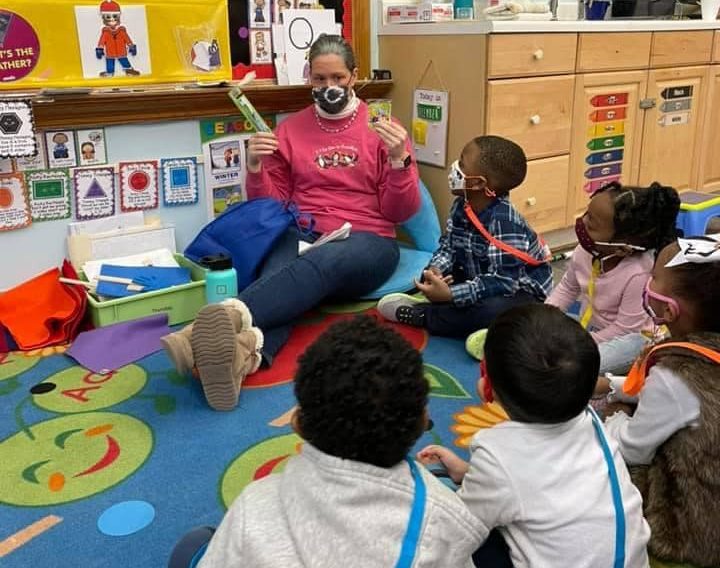

Preschoolers at Holy Name School in Omaha gather around as their teacher, Jessica Grasmick, teaches them about dental health in February. State senators recently visited Holy Name and other Omaha Catholic schools to learn about their education efforts, as part of a push for a scholarship tax credit bill. Visiting the schools in person was eye opening for the senators, said Jeremy Ekeler, associate director of education policy for the Nebraska Catholic Conference. COURTESY PHOTO

News

Filibuster ends scholarship tax credit bill, but support for legislation keeps growing

May 20, 2021

Seeing is believing, school choice advocates have learned.

LB364 – a bill that would have provided scholarship opportunities for students from low-income families to attend private schools – was defeated last month after it fell four votes shy of overcoming a filibuster in the state Legislature.

Proponents were disappointed in the outcome, but progress was made, said Jeremy Ekeler, associate director of education policy for the Nebraska Catholic Conference (NCC).

In lobbying and debate, people were persuaded, minds were changed and momentum continued to grow as supporters worked to raise awareness, educate and dispel some myths about the bill and about private and parochial schools, Ekeler said.

Particularly helpful, he said, were tours of several schools coordinated for senators by the NCC and Nebraska Family Alliance, with key help from Sen. Lou Ann Linehan of Elkhorn, who introduced LB364 and made it her priority bill.

The school tours were held in different areas of the state. One in Omaha included Holy Name, Our Lady of Lourdes, Ss. Peter and Paul and the Dual Language Academy.

Overall, “those schools were so impressive,” Ekeler said, that they “changed the way opponents see our schools.”

Sens. Patty Pansing Brooks of Lincoln and Lynne Walz of Fremont, who had adamantly opposed similar measures in previous legislative sessions, didn’t support the filibuster against LB364, but took a more neutral “present not voting” stance, Ekeler said.

“The tours were really important because they showed just how amazing our educators are,” he said. “That changed the narrative for the first time in my years of following” such measures. “A lot of the conversation was about all the great things Catholic and private schools are doing.”

“The narrative change was to one of real respect and admiration for the work of Catholic schools,” he said. “So that was a big change.”

LB364 would have created a tax credit for Nebraskans who donate to nonprofit scholarship funds for private school students from low-income families.

Sen. Justin Wayne of Omaha has had a change of heart on the legislation since he first became a state senator.

His testimony this year before the Legislature on behalf of LB364 gained national attention.

A constituent he talked with likened the potential scholarships to a life preserver being thrown to her son and students like him, Wayne said.

“Every child should have access to a high-quality education, not by chance, not by privilege, but by right,” the senator said.

The student achievement gap in east Omaha, including his northeast Omaha district, has grown over the past 12 years, and for those students the public education system is failing, he said.

“We shouldn’t criticize parents for wanting something better than the school they’re stuck with,” Wayne said. “I believe that it’s unfair, unjust and just flat out wrong to not give parents a choice.”

Linehan said the legislative defeat was frustrating, but she sees a bigger, brighter picture.

“It’s like climbing a mountain,” she said. “You’ve got to look behind once in a while and see where you started from.”

Adjustments to the legislation will continue to be made to ease concerns of critics and help it advance next year, Linehan said. Those changes might include capping the amount of the tax credit to a specific figure, instead of a percentage, for individuals and for companies, she said.

Under the bill that failed, taxpayers would have received tax credits up to 50% of their yearly tax liability. The state would have capped the total amount to $5 million in tax credits annually.

Linehan said she also plans to try to move the measure out of committee and to full floor debate sooner in the next legislative session, “when people are still in good moods.”

Senators tend to get tired as a session wears on, she said.

More coalition building, through the NCC, Nebraska Family Alliance and other groups, also will help, Linehan said.

“Anytime you’re trying to do something, you have to build a team,” she said. “We have a team, and we just need to add to it and we can get this done.”

Ekeler said seeing the senators’ reactions to visiting Catholic schools has helped him and the NCC sharpen their focus.

“My job going forward is exposing people to the truth – not just combating falsities and lies with a sharp rebuttal,” he said.

Changing minds and votes “is like evangelization, it’s personal. It’s having an encounter that’s heart to heart.”